|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Home » Central Banks Worldwide » Central Bank of the Philippines | ||||||||||||||||||||||||

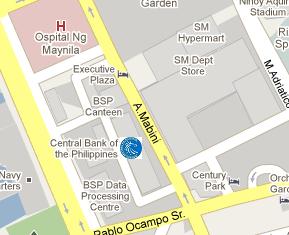

Central Bank of the Philippines |

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

The Bangko Sentral ng Pilipinas (BSP) is the central bank of the Republic of the Philippines. It was re-chartered on July 3, 1993, pursuant to the provision of the 1987 Philippine Constitution and the New Central Bank Act of 1993. The BSP was established on January 3, 1949, as the country’s central monetary authority. The powers and function of Bangko Sentral are exercised by its Monetary Board, whose seven members are appointed by the President of the Philippines. |

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

As provided for by the New Central Bank Act, one of the government sector members of the Monetary Board must also be a member of the President's Cabinet. Members of the Monetary Board are prohibited from holding certain positions in other government agencies and private institutions that may give rise to conflicts of interest. Being the central bank of the country, Bangko Sentral has been entrusted with the responsibility to formulate and conduct monetary and credit policy in a manner consistent with the Government’s targets for growth and inflation control. |

||||||||||||||||||||||||

|

The Bangko Sentral has supervision over the operations of banks and exercises such regulatory powers as provided in the New Central Bank Act and other pertinent laws over the operations of finance companies and non-bank financial institutions performing quasi-banking functions. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| The Bangko Sentral ng Pilipinas accepts that the credibility of its policy and actions is a prerequisite for the attainment of its goals and that such credibility can only be achieved and maintained through independent action, firmness of principle, resoluteness and fixed intent. | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

|

|

|

DISCLAIMER |

||

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved | ||