|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Home » Central Banks Worldwide » Central Bank of Brazil | ||||||||||||||||||||||||

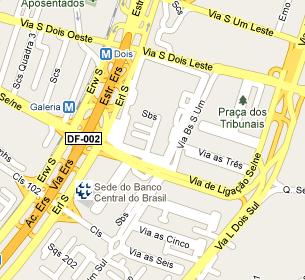

Central Bank of Brazil |

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

Before the creation of the Central Bank, the Brazilian monetary authorities were the Currency and Credit Superintendence (SUMOC), the Bank of Brazil (BB) and the National Treasury. |

|

||||||||||||||||||||||

|

Banco do Brasil carried out the functions of the government bank: controlling foreign trade operations; executing foreign exchange operations on behalf of public sector enterprises and the National Treasury; executed the rules set forth by the SUMOC and the Bank for Agricultural, Industrial and Commercial Credit, as well as receiving reserve requirements and voluntary deposits of commercial banks. The National Treasury was the currency issuing authority, but the issuing process was a complex one involving several governmental entities. In 1985, the decision was made towards a financial reorganization of the government, with a breaking down of the accounts and functions of the Central Bank, the Bank of Brazil and the National Treasury. |

||||||||||||||||||||||||

|

In the 1986 fiscal budget, not only all the revenues and expenditures of the National Treasury were included, but also all the accounts of fiscal nature that were under the Monetary Budget. In 1986, the 'movement provisional account' was extinguished and, from then on, the disbursement of funds from the Central Bank to the Bank of Brazil were clearly identified in the budgets of each institution, eliminating the automatic transfers that hampered the management by the Central Bank. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| Adopting the IASB rules shall increase comparability of the Central Bank of Brazil accounting statements, since it will enable a better understanding of its operations by foreign entities. This shall yield the institution greater external credibility. Clearly, central banks conduct specific operations that are not contemplated by the IASB rules and therefore will need specific treatment. In order to cope with such cases, the BCB intends to observe the best accounting practices of other central banks. | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

DISCLAIMER |

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved |