|

|||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||

| Home » Central Banks Worldwide » Bank of the Republic of Burundi | |||||||||||||||||||||||||||||

Bank of the Republic of Burundi |

|||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||

|

|

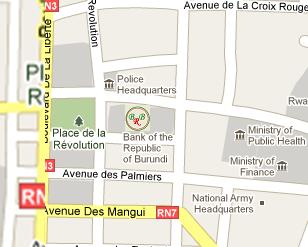

The Bank of the Republic of Burundi (French: Banque de la République du Burundi, BRB) is the central bank of Burundi. The bank was established in 1966 and its offices are in Bujumbura. BRB as the central bank of Republic of Burundi executes all the functions that a central bank traditionally performs as elsewhere in the world. As the central bank of the Republic of Burundi, BRB reserves sole responsibility to issue bank note in the Republic. |

|

|||||||||||||||||||||||||||

|

BRB formulates and implements monetary policy aiming at stabilizing domestic monetary value and maintaining competitive external per value of Burundian franc for fostering growth and development of country’s productive resources in the best national interest. BRB monitors and supervises scheduled banks and non-bank financial instructions (NBFIs) that include off-site supervision and on-site supervision in order to enhance the safety, soundness, and stability of the banking system to ensure banking discipline, protect depositors’ interest and retain confidence in the banking system. |

|||||||||||||||||||||||||||||

|

It also has the power to buy and sell gold and can well manage and detain exchange reserves of the country. The Bank functions mainly from Bujumbura. The task of management lies with the Management committee comprising of the Governor and a couple of Vice Governors.

The franc is the currency of Burundi. Regular issues of bank notes began in

denominations of 10, 20, 50, 100, 500, 1000 and 5000 francs. |

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

The Bank of the Republic of Burundi must be well managed and pursue a goal-oriented approach, as consistent as possible with international best practice. The Bank was also given the responsibility of establishing the discount rate and intervening to control interest rates. |

|||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||

|

DISCLAIMER |

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved |