|

|||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

| Home » Central Banks Worldwide » Bank of Guyana | |||||||||||||||||||||||||

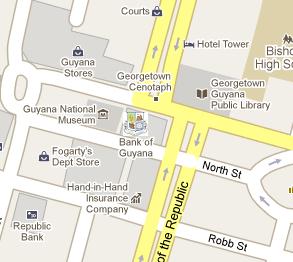

Bank of Guyana |

|||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

|

Bank of Guyana was established in 1965 and is located in the capital city of Georgetown. The mission of the Central Bank is to maintain domestic price stability, through the prudent formulation and implementation of monetary policy. The Bank actively fosters conditions for a sound, efficient and progressive financial system. Within the context of the economic policy of the Government, the Bank shall be guided in all its actions by the objectives of fostering monetary stability and promoting credit and exchange conditions conducive to the growth of the economy of Guyana. |

|

|||||||||||||||||||||||

|

The Bank commenced issuing the new national currency notes on November 15, 1965, to replace the BCCB notes, the issuance of which was expected to cease by December 31, 1965. However, national coins were not issued until the mid 1967. To date, the Bank has maintained De La Rue and the Royal Mint as suppliers of the nation's currency. Apart from specifying the administrative and management arrangements for the Bank, the Ordinance, inter alia, decreed the Bank to: |

|||||||||||||||||||||||||

|

In achieving the objectives above, the Bank of Guyana are commits itself to providing

effective support functions through a sound banking and financial control

system, appropriate information system and the development of competent and

qualified staff. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

The Financial Institutions Act No.1 of 1995

which came into operation on the May 29, 1995 created the framework for the

regulation of the business of banking and other financial business in

Guyana. This Act consists of nine parts which includes requirements related

to licensing of financial institutions, paid up capital, restrictions on

banking and financial activities, supervision of licensed financial

institutions and provisions for insolvency and winding up. The Financial Institutions Act remained substantially unchanged since its enactment in 1995 until November 2004 when amendments were made by way of modification of some sections of the Act and the inclusion of new emergency provisions dealing with temporary control. |

|||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||