|

|

| |

|

| |

|

|

Home

»

Bank

Negara Malaysia

»

CIMB Islamic Bank |

|

|

CIMB Islamic

Bank

|

|

|

|

|

|

CIMB Islamic

Bank is the global Islamic banking and finance franchise of CIMB Group,

ASEAN's leading universal banking franchise. The Bank offers an extensive suite of

innovative Shariah-compliant products and services that encompass consumer

banking, investment banking, asset management, takaful, private banking and

wealth management solutions in Southeast Asia and other major world cities. |

|

|

|

Head office

in Kuala Lumpur, CIMB Islamic’s main markets are Malaysia, Indonesia,

Thailand and Singapore, countries in which is have full universal banking

capabilities. Its presence covers Southeast Asia and global financial centres, as well as countries where

the Southeast Asian customers have

significant business and investment dealings.

|

|

|

|

|

|

|

|

|

|

|

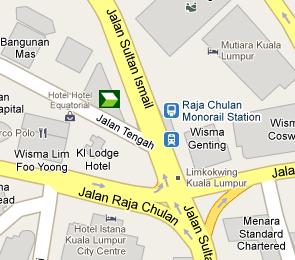

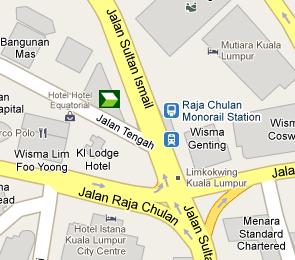

CIMB Islamic Bank Head Office

|

HQ

Address: |

1st Floor Menara Promet

Jalan Sultan Ismail

50250 Kuala Lumpur |

|

Telephone: |

+603 2145 5959 |

|

Facsimile: |

+603 2144 4746 |

|

SWIFT Code: |

CTBBMYKL |

|

Website: |

www.cimbislamic.com |

Banking Hours:

Monday - Friday 9.00am - 4.00pm |

|

|

|

|

|

|

|

|

As the Islamic financial market

turns more complex with the multiplicity of financial products and diversity

of Islamic asset classes, Shariah advisory has become more relevant than

ever. Leveraging on CIMB Group’s vast experience and intelligence, the

Shariah Advisory team is privileged with first hand insights into major

financial activities, including landmark pioneering deals.

|

|

|

|

|

|

The benefits of CIMB Group’s

structure and approach differentiate the Shariah Advisory team from other

Shariah advisors. Involvement in the development and implementation of a

wide array of Islamic financial products and post-approval Shariah

compliance reviews has enhanced the Shariah Advisory team’s experience. CIMB

Islamic Shariah Committee hosts a balanced mix of international expertise

from the various international jurisdictions, allowing the Bank to provide

effective Shariah management and amicable resolution of jurisdictional

issues. Capitalizing on these strengths, we are poised to meet our

international clients’ business expectations and needs, whilst maintaining

adherence to Shariah. |

|

|

|

|

|

DISCLAIMER

The content comes from Internet, reasonable efforts are made to maintain accuracy of information published.

However, information could contain errors or inaccuracies and is presented

without warranty and statutory means.

Viewers are advised to

consult their banker or financial consultant for complete information and

their professional advise.

No liability is assumed for errors or omissions.

All trademarks, logos, brand names and copyrights are the property of their

respective owners. |

|

|

© 2011 - 2022 BankHeadOffice.com ® All

Rights Reserved |

|

![]()

![]()