|

|

| |

|

| |

|

|

Home

»

Bank

Negara Malaysia

»

Bank Islam Malaysia |

|

|

Bank Islam

|

|

|

|

|

|

Bank Islam

emerged as Malaysia’s maiden Shari’ah-based financial institution since its

establishment in July 1983. Bank Islam has become the symbol of Islamic

banking in Malaysia. Through a vast growing network of 112 branches and more

than 800 self-service terminals nationwide, Bank Islam parades a

comprehensive list of more than 50 innovative and sophisticated Islamic

banking products and services, comparable to those offered by its

conventional counterparts. |

|

|

|

Being the

pioneer in the industry, Bank Islam has played a leading role in promoting

the expansion of Malaysia’s brand of Islamic finance into other markets,

especially in the region. This has helped develop Bank Islam into a

well-established and universally recognized brand. As the number of local

and global financial services continues to increase, Bank Islam remains

keenly aware of the pioneering role it must continue to play. |

|

|

|

|

|

|

|

|

|

|

|

|

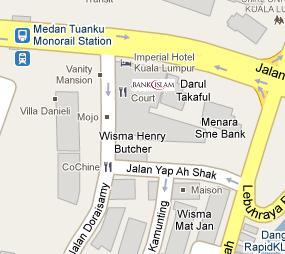

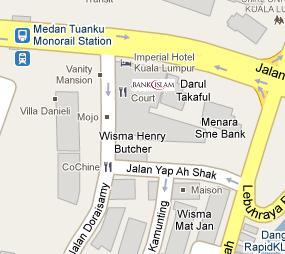

Bank Islam Malaysia Head Office

|

HQ

Address: |

Tingkat 14, Darul Takaful

Jalan Sultan Ismail

50734 Kuala Lumpur |

|

Telephone: |

+60

3 2693 5566 / 5569 |

|

Facsimile: |

+60

3 2694 9077 |

|

SWIFT Code: |

BIMBMYKL |

|

Website: |

www.bankislam.com.my |

Banking Hours:

Monday - Friday 9.00am - 4.00pm |

|

|

|

|

|

|

|

|

From the traditional financing,

savings and investment types of products exclusively for individual

customers in the early years of establishment, Bank Islam’s Shariah-based

financial solutions today are all-encompassing including those related to

micro finance, wealth management, capital market, business banking,

investment banking, treasury and structured products, among others,

customised to suit financial needs of all customers at every stage of life.

Customer centric focus is the main thrust in pushing the Bank to constantly

evolve and bring its capability and capacity up to date.

|

|

|

|

|

|

Notwithstanding the increasing

number of Islamic financial products, services and players in Malaysia and

abroad, Bank Islam will continue to play its role as a pioneer-leader in

enhancing its first-mover advantage and unique value propositions while

reinforcing Malaysia's distinctive competitive advantages as a leading

international centre for Islamic finance.

|

|

|

|

|

|

|

|

|

DISCLAIMER

The content comes from Internet, reasonable efforts are made to maintain accuracy of information published.

However, information could contain errors or inaccuracies and is presented

without warranty and statutory means.

Viewers are advised to

consult their banker or financial consultant for complete information and

their professional advise.

No liability is assumed for errors or omissions.

All trademarks, logos, brand names and copyrights are the property of their

respective owners. |

|

|

© 2011 - 2022 BankHeadOffice.com ® All

Rights Reserved |

|

![]()

![]()